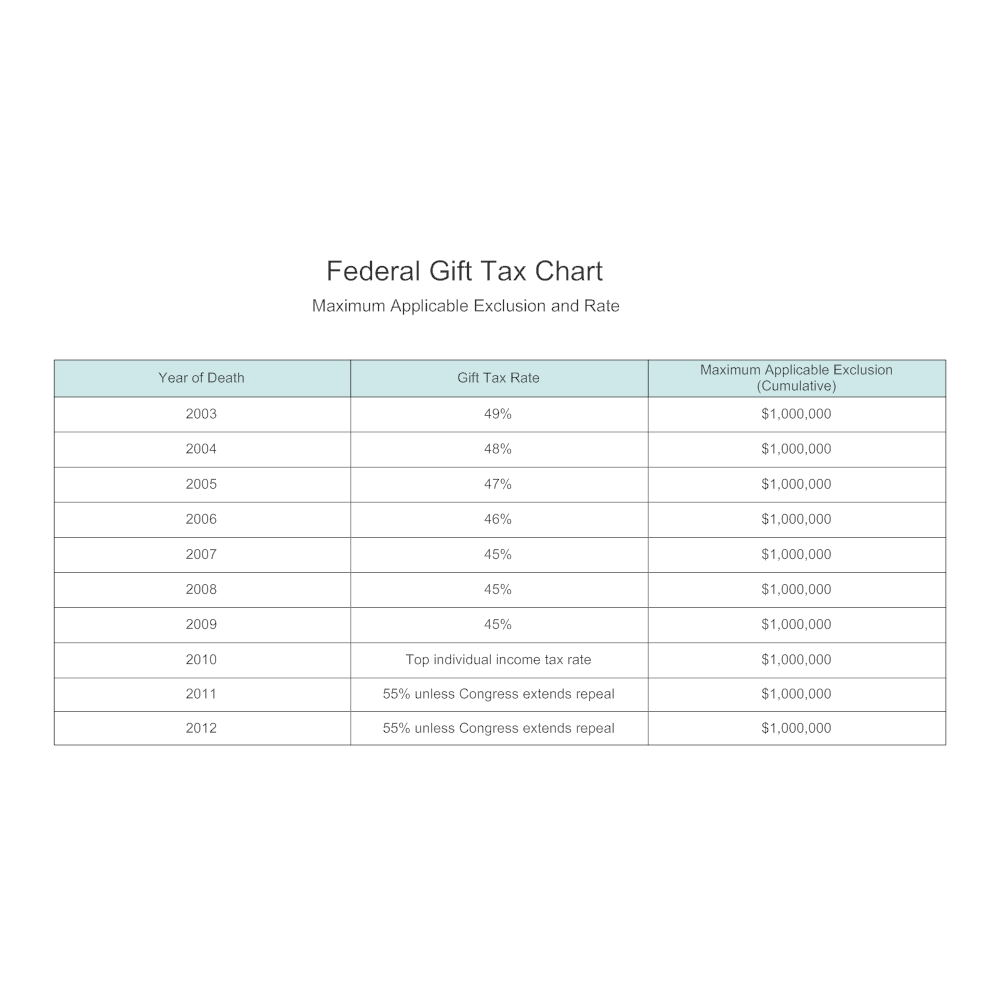

2025 Gift Tax Amount. What are the 2025 estate tax and gift tax limits? The internal revenue service has announced inflation adjustments for tax year 2025 (rev.

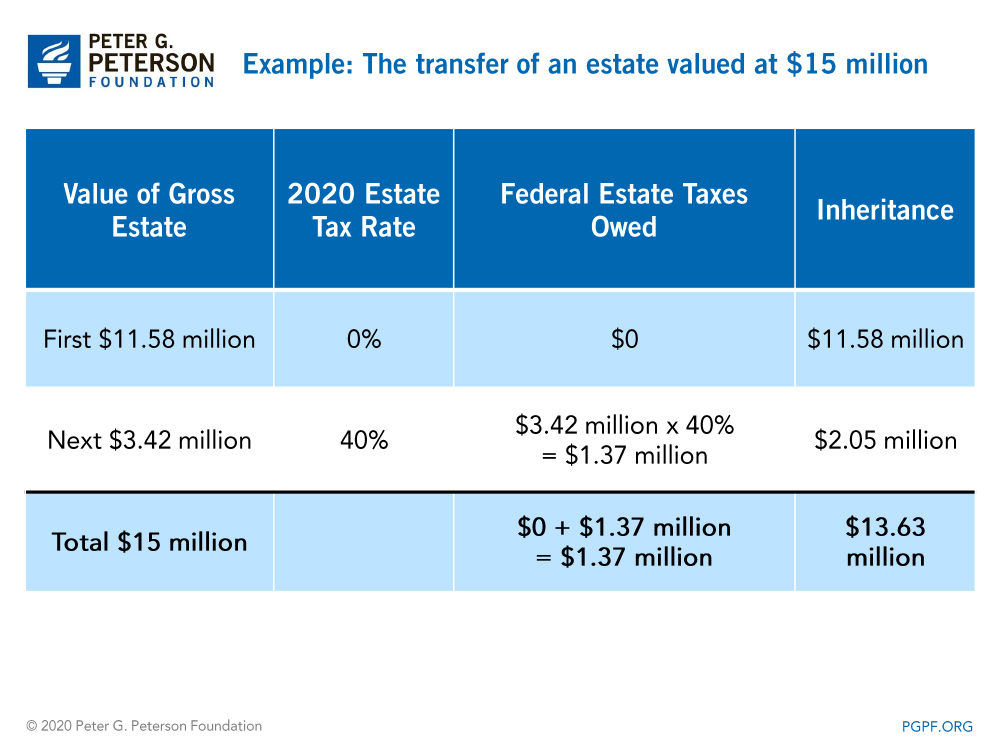

In other words, giving more than $19,000 to any individual in 2025 means you may have to file a gift tax return. Speaking of the lifetime exemption, the estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2025.

Gift Tax For 2025 Ellyn Hillary, The gift tax exclusion amount renews annually, so an individual who gifted.

Gift Tax Rates 2025 Irs Ryan Greene, The irs released the 2025 annual inflation adjustments for various tax provisions.

2025 Gift Amount Allowed William Bower, In a significant update for estate planning and wealth management, the internal revenue service (irs) has announced an increase in the estate and gift tax exemption for 2025.

2025 Lifetime Gift Tax Exclusion Amount Worksheet Edward Springer, The 2025 federal estate and gift tax exemption will be increased to $13,990,000, up from $13,610,000 in 2025.

2025 Gift Amount Allowed William Bower, Wedding gifts enjoy a unique status under indian tax laws.

Gift Tax Exemption 2025 Understanding The Lifetime Exclusion And Its, In 2025, you can make annual gifts to any one person up to a maximum of $18,000 per year ($19,000 in 2025).

Gift Tax 2025 Limit 2025 Zoe Lyman, Spouses can elect to “split” gifts, which doubles the annual amount a married couple can give away in any year.

2025 Gift Amount Allowed William Bower, This generally means that an estate of a decedent who dies in 2025 with combined assets and prior taxable gifts in excess of $13,990,000 must file a federal estate tax return (form 706), and federal estate tax may be due.

2025 Gift Tax Annual Exclusion Anthia Brigitte, For 2025, this amount will also be $13.99 million per individual or $27.98 million per married couple.